Reversing the Financial Coup d’Etat—Critical Issues in U.S. Federal Finances: A Briefing Memo for U.S. Federal and State Candidates and Legislators

August 2023

By Catherine Austin Fitts

I. Introduction

II. Governance

III. U.S. Constitution and Federal Financial Laws

IV. Sovereignty

V. The U.S. Dollar System and the Going Direct Reset

VI. Financial Transaction Freedom

VII. Inflation and Deflation

VIII. The Central Banking-Warfare Model

IX. A Word About Energy

X. Next

Appendix: Selected Statistics re: Global Economy and Financial Assets

I. Introduction

This paper provides an overview of critical issues related to the U.S. federal finances and the systemic lawlessness of current federal financial management.

Our goal is to help:

- U.S. presidential candidates and their staff and economic advisors understand the critical issues to be addressed to reform the U.S. federal finances.

- State officials and legislators and their staff understand the urgency of taking legislative and operational action to protect their governmental sovereignty as well as the financial transaction freedom of their state, political subdivisions, financial institutions, and citizens.

This is the second publication from the Solari Report regarding 2024 U.S. campaign issues. The first was on the Second Amendment.

Not surprisingly, there is a direct connection between the financial coup d’état occurring in the U.S. government and the failure to respect other aspects of the U.S. Constitution, including the First and Second Amendments.

If you are eligible to vote in the United States, we want to underscore the importance of investing your time and resources to support candidates who are acting to protect your financial freedoms, particularly your state legislators.

II. Governance

The most important question in any financial system is “Who?” Who controls? Who decides? Who has what powers, authorities, and responsibilities?

The U.S. federal financial system is a subset of the governance system. The governance and financial systems must be understood together—and if reformed, reformed together. Tinkering with a financial system without understanding and paying attention to the governance system is an invitation for serious trouble. Always ask and answer the “Who’s who?” question about any proposed reform: “Who wins and who loses?”

The U.S. Constitution outlines the powers delegated to the federal government by the states. If you have not read the Constitution in its entirety, it is advisable to do so.

In the description of the powers of Congress to issue and spend money, Section 9, Article I of the U.S. Constitution states:

“No Money shall be drawn from the Treasury, but in Consequence of Appropriations made by Law; and a regular Statement and Account of the Receipts and Expenditures of all public Money shall be published from time to time.”

In short, Congress has to approve expenditures before funds are spent, and reports of expenditures must be published on a regular basis.

Pursuant to federal financial laws and regulations, U.S. monetary policy is currently delegated to a central bank—the Federal Reserve System (“the Fed”). The Fed consists of 12 private, member-owned banks—of which the Federal Reserve Bank of New York (“New York Fed”) is the largest in terms of assets and volume of activity—and a Board of Governors appointed by the President and confirmed by the U.S. Senate.

Fiscal policy is governed by the U.S. Congress and implemented by the executive branch. Currently, fiscal appropriations and credit are allocated on a highly political basis, without interest in what optimizes local economies and family wealth. I describe the federal expenditure of appropriations and credits in U.S. communities and counties as having a “Negative Return on Investment.” There is little disclosure that is accessible or understandable to most citizens, particularly disclosure that is understandable contiguous to the Congressional districts in which citizens vote for political representatives. Such disclosure would be an important and welcome reform.

Currently, the central bank is asserting increased control over fiscal policy. This is facilitated by a debt-based currency system as well as New York Fed control of U.S. government accounts as depository and as manager of the Exchange Stabilization Fund. We see both monetary policy and fiscal policy defined by significant and growing secrecy, which is supported by misleading narratives in the corporate media. Those feeding at the trough perpetuate the cycle by reinvesting in controlled media and propaganda.

Make no mistake: The next U.S. President will be faced with the challenge of either reforming and reversing these trends—the financial coup d’état—or conceding a collapse of the republic and its finances in favor of a fascistic system of control by the central banks and the private interests they represent.

Indeed, collapsing the republic and auctioning off its assets in the ensuing chaos would offer immense opportunities to acquire and control all the real assets of the United States—much like what occurred at the collapse of the Soviet Union, which was very much a financial war and genocide led by U.S. financial interests, law firms, universities, and intelligence agencies allied with organized crime.

Political candidates run the risk of being increasingly financed and lobbied by investors and entrepreneurs who appreciate the immense profit opportunities that would accompany a furthering of the financial coup d’état and the accelerated genocide that would result—again, as took place in Russia in the early 1990s. Expect those campaign funders and lobbyists to promote “populist reforms” that will result in candidates who support their predatory disaster capitalism agendas.

Now that the debt growth model is over, there is a serious competition to control real assets, particularly land, farmland, associated water and minerals, and real estate. Following decades of artificially created financial bubbles engineered using the federal credit by the central and commercial banks acting in concert with the U.S. government, a too-complex system of record ownership of property characterized by a mountain of out-of-control paper and digitalized recording systems has been created with layers and layers of asset pools and assignments of titles, security interests, and liens—enabling the overleveraging or overcollateralization of real assets.

As a result, the ultimate competition, now underway, is for what is real. Hence, there is an explosion of effort to attract retail investors into “shiny objects” in the form of digital assets, while the smart money buys up or gets control of the real assets. One of the most dangerous potential scenarios would be for a candidate to promote “sound money” policies that throw the economy into a deflation; this would advantage the players who already have been the beneficiaries of more than a decade of central banking largesse and who could then buy up large amounts of real assets at attractive prices.

Candidates would be well served to not be tricked in this manner. It is essential to run all financial and economic proposals through a vetting process that includes looking at them through an economic warfare prism that asks and answers, “Who wins and who loses?”

It is also important to remember that one of the primary sources of campaign donations is from the capital gains generated in the financial and real estate markets. This has been one of the drivers of Congressional support for centralizing control—shifting Main Street income into publicly traded companies using government policies such as the pandemic lockdowns. I describe this phenomenon in my online book.

Related Reading:

III. U.S. Constitution and Federal Financial Laws

The U.S. Constitution and federal statutes, regulations, and administrative policies, including executive orders, dictate the legal framework for how U.S. governance and federal finances are supposed to work.

The Solari Report has published a series of seven briefing papers to describe the legal structure of federal finances. These papers were commissioned to enable readers to gain intellectual mastery of the basic legal framework and recent history of federal financial management in the U.S.

These seven papers are described below.

The first briefing paper describes U.S. monetary policy and the management role of the Fed.

Understanding the governance of monetary policy is critical for a presidential candidate. The President nominates the Chairman, Vice-Chairman, and members of the Board of Governors of the Federal Reserve System but does not control the system and does not have access to much of its data and intelligence.

As mentioned, the New York Fed is the flagship bank of the 12 private Fed banks—each owned by its member banks—and serves as agent managing the Exchange Stabilization Fund. Both the Fed and the New York Fed are shareholders in the Bank for International Settlements (BIS) in Basel, Switzerland, the “central bank for central banks.”

The BIS has 63 central banks as members and plays a unique role in the global financial system, as it and its officers and directors enjoy sovereign immunity created under its Swiss charter and recognized through the treaty process by the nations of its member central banks. It currently operates hubs around the world helping to implement central bank digital currencies (CBDCs). The BIS system of banks, insurance companies, and payment systems designated as “systemically important,” which are granted a type of preferred status that is reflected in the home countries of member central banks, appears to extend the BIS sovereign immunities to numerous private institutions that are important in the global financial system, whether by express authorization or de facto recognition of the powers of sovereign immunity.

Three of the Solari briefing papers outline the basics of U.S. fiscal policy and the failure of the U.S. Congress and Executive Branch to manage federal finances according to the law.

- The Appropriations Clause: A History of the Constitution’s (As of Yet) Underused Clause

- The U.S. Statutes Creating Modern Constitutional Financial Management and Reporting Requirements and the Government’s Failure to Follow Them

- The Black Budget: The Crossroads of (Un)Constitutional Appropriations and Reporting

The U.S. government is the largest issuer of securities in the world: according to official statistics, current outstanding U.S. debt is $33 trillion. Most U.S. voters—through their pension funds, retirement savings, insurance products, and banks—have meaningful holdings in these securities or that depend on these securities.

The fifth briefing paper describes the reasons why SEC Rule 10-b5 (the major U.S. securities fraud statute), which requires meaningful disclosure to purchasers and sellers of securities, may not protect investors when national security exemptions from otherwise-mandatory financial statement disclosure are in play.

The sixth briefing paper provides a summary overview of the U.S. federal system for document classification.

The final briefing memo describes the Federal Accounting Standards Advisory Board Statement 56 (FASAB 56). Published in October 2018, FASAB 56 reflects an attempt to undermine U.S. Constitutional provisions and financial management laws by administrative policy to permit the federal government to maintain secret financial books and records and convert government financials to a state of near complete mystery.

IV. Sovereignty

If you are going to serve as the President of the United States, then you must appreciate the pressing need for the U.S. government to regain financial and information sovereignty if the government is to endure.

If private banks and contractors control your cash flows, your borrowings, your accounts, and all the related data, including data that are secret and withheld from you, you and your team will need to first and foremost face the fact that one of your primary tasks is to return the U.S. federal government to a state of financial sovereignty.

If you do not, you will be like the driver of a bus whose steering wheel does not connect to the real wheels. You are a marketing front, but you have no say over where the bus goes.

U.S. sovereignty has been compromised in a variety of ways, including through private control of information and communications, dependency on private banks, indebtedness, global agreements and outside-the-law international entities, conflicts of interest, and use of covert force.

1. Private Control of Information and Communication Systems

Federal communications, information, and payment and accounting systems depend upon private telecommunications, defense, and big tech contractors that have largely wrested control over these systems from federal employees. It is doubtful that the U.S. President can even have a private telephone call without surveillance by numerous U.S. and foreign intelligence agencies and private corporate contractors.

To appreciate the threat posed by the system of private control over national finances, read Greek Finance Minister Yanis Varoufakis’s account of his unsuccessful attempts to implement the electorate’s populist mandate in 2015 in the face of private contractors’ and banks’ control of national Greek assets. In the end, the European Union and European Central Bank, and not the sovereign Greek government, controlled how Greece could and would be stripped of its real assets.

2. Dependency on Private Banks

The New York Fed controls the U.S. government depository function and governs the primary dealer system which manages government borrowings. It also serves as agent for the Exchange Stabilization Fund and, in that capacity, has broad powers to buy, sell, and otherwise intervene in global markets.

Part of the Fed’s power comes from the U.S. dollar debt-based currency system, under which the Treasury issues debt rather than simply issuing currency to pay for its expenses. Exacerbating the drain on the economy from interest payments on debt is the fact that proceeds of that debt and income from federal income taxes have been disappearing from U.S. accounts since at least fiscal year 1998 when, notwithstanding financial management laws to the contrary, two federal agencies were unable to provide clean audited financial statements.

Between fiscal 1998 and 2015, trillions of dollars of undocumentable adjustments (unverified transactions) were reported in the accounts of the Department of Defense ($20 trillion) and the Department of Housing and Urban Development ($1 trillion).

It is not possible to determine how much money and credit and how many assets are missing. First, the numbers could represent both inflows (such as funds or assets laundered in from global war zones) or outflows (such as illegal weapons sales out the backdoor of a military arsenal). The possibilities in a budget and operation this big are endless. It is conceivable that the actual net value of these transactions is much bigger (or much smaller) than the total amount of unverified transactions—including both the transactions that have been identified and the ones that occurred subsequently to 2015, which are secret. (Because of the failure to disclose undocumentable adjustments after fiscal 2015 as well as post-FASAB Statement 56, the true extent of undocumentable adjustments has been obscured.) What we do know is that the numbers are so significant over two decades that this is financial management operating on a criminal basis. As one Congressional staffer once remarked to me, “HUD is being run as a criminal enterprise.”

The U.S. Treasury refuses to publish audited or auditable financial statements as required by law and the U.S. Constitution, and it has now adopted administrative positions—FASAB Statement 56—that “authorize” the government and its agencies, banks, and contractors to run their books on a secret basis. In fact, under SEC rules, in the name of national security, U.S. government contractors are permitted to obfuscate their financial dealings with the government in SEC financial statement filings pursuant to exemptions comparable to those in operation under FASAB Statement 56 for the government.

3. Indebtedness

The U.S. government has $33 trillion of officially outstanding debt, although total outstanding U.S. government liabilities are a much larger number. Current U.S. annual interest payments have surpassed total annual U.S. military expenditures.

The most important thing to understand about the U.S. national debt is that it does not need to exist. The U.S. Treasury could have simply issued $33 trillion of currency and then managed its own bank accounts (as opposed to having the New York Fed banks do so), so that $21 trillion (or whatever the real number is) did not disappear. We do not need a debt-based currency system, and U.S. taxpayers do not need to finance bank robberies of debt proceeds.

With $33 trillion of unnecessary debt and, for purposes of demonstrating this point, $21 trillion of missing money (and counting), we face a $54 trillion shortfall that needs to be addressed. The obvious question is, “Where did the money go, and how does the U.S. government assert jurisdiction over the assets financed with the stolen funds?”

Related Reading:

- Caveat Emptor: Why Investors Need to Do Due Diligence on U.S. Treasury and Related Securities

- The Missing Money

- Does the BIS Owe Us $21 Trillion (Or Owe You $65,000)?

4. Trade and International Agreements and Sovereign Immunity of International Organizations

Since World War II, trade agreements have created backdoor mechanisms that have steadily compromised national and state sovereignty. We have covered this in a series of interviews on secrecy and international treaties with attorney Amy Benjamin, on the BIS with Patrick Wood, and on the proposed WHO International Health Regulations Amendments and Pandemic Treaty (CA+) with James Roguski. We have also republished an excellent two-part series by Corey Lynn on hundreds of international immunities created under various treaties and international agreements for governmental and nongovernmental organizations.

Related Reading:

- The Many Faces of Secrecy with Amy Benjamin

- Sneaky Treaties: Globalists and the Corruption of International Law with Amy Benjamin

- The Iron Bank: Is BIS Sovereign Immunity the Secret Sauce Behind the Global Coup? with Patrick Wood, Part I and Part II

- Laundering with Immunity: The Control Framework by Corey Lynn, Part I and Part II

- WHO Do You Think You Are? The Nuts and Bolts of Global Power with James Roguski

5. Personal Compromise

Government and Congressional leaders have been significantly compromised by factors such as dual citizenship, “control files,” and the possibility of secret contracts, creating substantial conflicts of interest. One of your most critical tasks in dealing with federal finances is building a Cabinet and economic team that is not openly or secretly compromised by conflicts of interest. This means establishing a significant vetting capacity on your transition team and in White House personnel. The knowledge, experience, and integrity of the people you choose to run your transition team and White House are of the utmost importance.

6. Sovereign Monopoly vs. Private Covert Force

The U.S. population is experiencing a breakdown of law and order, which includes the increasing use of private and covert forces operating on the border, or in the United States and its air space. These forces are poisoning and killing Americans with impunity. While Operation Warp Speed was clearly implemented by the U.S. military, there is no way to tell who is carrying out some of these other operations. Is it the U.S. military (or military contractors funded by U.S. tax dollars), or instead, are operations being implemented by private military and crime cartels, with the Department of Defense’s tacit or overt permission?

In short, does the U.S. have a monopoly on force within its borders, subject to the jurisdictions of the states, or has this monopoly been lost? Loss of this monopoly inevitably will lead to governmental implosion and threatens tax collections and financial operations. The latest downgrade of the U.S. credit rating by Fitch made reference to a deterioration in “governance.”

Given these threats to U.S. sovereignty, an incoming President and his team will face the following critical questions:

- How will you establish information sovereignty, and how will you maintain private communications until you do?

- How will you access accurate and complete data on U.S. finances and operations, including all monies stolen and illegally transacted since fiscal 1998?

- How will you establish banking and transaction systems that are controlled by the U.S. government and not by the private central bank and its members? How will you shift from a currency controlled by the central bank, which necessitates that the government issue debt, to a fiat currency that does not require the government to take on unnecessary debt?

Indeed, history has demonstrated that fiat currencies can work very well, far better than commodity-based currencies. The current problems with the dollar are a secret governance and banking system, secret expenditures that are funding powerful technology and operations, and the fact that the system is debt-based. The problem is NOT that it is a fiat currency.

- Book Review: A History of Money in Ancient Countries from the Earliest Times to the Present by Alexander del Mar

- The Guernsey Experience

- How will you stop monies from disappearing from U.S. accounts? How will you get the $21 trillion back (or whatever the net number is—perhaps audits of accounts post-2015 would show that it is even more)? How will you assert control over any assets financed with stolen monies? How will you hold the appropriate parties accountable? How will you identify any funds transferred through the New York Fed to or through the BIS, which by law has rights of secrecy and enjoys sovereign immunity protection?

- How will you protect federal and state sovereignty from compromise resulting from application of force by private parties, including the use of weather warfare and other invisible weaponry, such as directed energy weapons, entrainment, and mind control technologies?

Related Reading:

- Sovereignty by John Titus

- The Data Beast

- Mind Control Tactics Used on Young People and Children (and Everyone Else)

V. The U.S. Dollar System and the Going Direct Reset

In 2019, the Solari Report published my overview of the dollar currency system, including a history of the dollar as the global reserve currency.

Among other issues, we described the system of global war and indebtedness that the U.S. has used to operate and finance a global empire.

One of the tensions inherent in trying to manage the dollar system is sharing responsibility on aspects of fiscal policy with voting populations who—after years of a lethal combination of subsidy and secrecy—do not possess basic literacy regarding federal finances. Moreover, as voters’ dependency on federal financial subsidy has grown, they have shown little appetite for balanced books.

In August 2019, the G7 central bankers met in Jackson Hole, Wyoming to review and adopt a plan—the Going Direct Reset—to dramatically reengineer federal finances and further centralize control of global resources. We published a detailed description of the Going Direct Reset by John Titus.

This was followed by a series of publications that document and describe the use of digital technology to assert complete control of citizens globally—amounting to the end of human liberty in the Western world.

When the World Economic Forum says, “It’s 2030, and you have no assets,” it is important to understand that CBDCs, vaccine passports, and other forms of financial transaction surveillance and control are critical tools to achieve this vision of ending property rights for a large portion of the population.

VI. Financial Transaction Freedom

Government sovereignty is intimately related to individual sovereignty.

Efforts are now underway to assert complete control over financial transactions—including those of states, counties, and municipalities; pension funds; governmental corporations; citizens; and private enterprises—facilitated by digital IDs, digital payment systems, and CBDCs. These digital systems, taken together, allow a centralized authority to assert complete central control over each and every individual’s resources and behavior.

At the request of one state government official, the Solari Report published an overview of financial transaction freedom. This is a must-read for every candidate for public office.

- Financial Transaction Freedom: What is it, what threatens it, and how do I take action to secure it?

As a candidate, you will be asked how you are going to protect individuals’ financial transaction freedom. You need to be prepared to answer this and similar questions about the future of financial freedom.

To help our broader audience, we also published the following article about CBDCs. It includes a series of short videos that do an excellent job of describing the central bankers’ goal of complete control through financial transactions and currency.

In addition, we conducted an interview that focuses on Europe’s central bank and the European playbook to achieve central financial control.

Related to this issue of who controls our bank accounts, banks, and government payment systems and currency is the question of whether citizens still enjoy the principle of “no taxation without representation.”

If the federal government is collecting taxes and then uses the proceeds in a manner that violates Constitutional and statutory provisions for financial management and disclosure, what are the obligations and opportunities for citizens and state and local officials to do something about this? We address that question and take an in-depth look at possible solutions here:

State and federal finances are highly interdependent, but that does not mean this interdependence cannot be unwound—albeit with significant consequences for all the parties, including the U.S. public and private pension funds and retirement accounts that purchase bonds which help finance state and federal government operations.

The question of usury is related to the taxation question. Usury essentially was legalized in the United States with the run-up in interest rates that began during the 1980s. The result has been to steadily erode personal finances. Whereas large banks have enjoyed bailouts and low interest rates (even zero and lower), U.S. credit card holders have been subject to average interest rates of 17+%, with rates going as high as 30+%, not including bank fees for financially struggling individuals and small businesses. My read of history is that as soon as a civilization legalizes usury, its failure is certain—the only question being how long this state of affairs can be maintained before ultimate collapse or takeover. So, add the outlawing of usury to your must-do list.

As part of the ongoing financial coup, the U.S. central bank appears to be trying to use its authorities and resources to aggressively centralize and consolidate control of the private banking system, as described in an interview with attorney John Titus.

Such consolidation will have devastating consequences for small businesses, small farms, and communities. It will also help facilitate the rapid consolidation of real assets into the hands of private investors. The lies and propaganda around this stealth consolidation effort have been quite significant.

The economic importance of having many small banks and credit unions is described by Dr. Richard Werner in his excellent interview and published briefing document for the Solari Report, described and linked in the interview.

You must act to protect and nurture the health and profitability of a wide, vital community of private banks and credit unions if you want small farms, small businesses, and income on Main Street—not to mention support for a democratic Republic.

VII. Inflation and Deflation

The monetary policies that are supporting the Going Direct Reset by the Fed and G7 central banks have led to a significant increase in monetary inflation and resulting price inflation, which is now being tempered by subsequent central bank hikes in interest rates. Combined with other policies instituted during the Covid-19 pandemic, which shut down or disadvantaged small enterprise, the result has been large amounts of capital concentrated in the hands of insiders and the destruction of millions of businesses, leading to continued centralization of economic and political power.

As this consolidation of ownership happens, we are watching a related series of efforts that could bring on serious and significant deflation—whether by means of an escalation of the war in Europe; continued development and use of artificial intelligence, robotics, and other forms of automation that lead to job elimination; further pandemic-type, government-imposed controls and lockdowns; or the imposition of resource policies and regulations alleged to address problems related to climate change and the food supply.

In addition, monetary, tax, and fiscal policies can be designed to create and engineer deflation as a tool of economic warfare. Many, if not all, CBDC and Bitcoin/crypto proposals as well as hard currency proposals (gold and silver) will be highly deflationary and are likely to advantage those players who have enjoyed federal and central bank largesse.

As already noted, the risk is of a scenario similar to what occurred with the “Rape of Russia,” when induced economic shocks and privatization were used to take advantage of the economic collapse of the Soviet Union in the early 1990s. Those measures allowed private players to accumulate ownership and control of Russian resources at fire-sale prices.

In the wake of this engineered economic warfare, political candidates most certainly will be asked to describe their plans for reducing inflation and reversing the windfall profits that are being enjoyed by the wealthy.

VIII. The Central Banking-Warfare Model

The federal finances—including both monetary and fiscal policy—are an integral part of the global central banking-warfare model. Reforming the federal finances must be part of changing or evolving the entire model.

Grossly oversimplified, the fundamental economics of the central banking-warfare model are as follows.

The central banks print currency.

The military and intelligence agencies make sure everyone accepts it in exchange for real labor and natural resources. Critical parts of this infrastructure include:

- Control and management of the global sea lanes: This was the traditional mechanism by which the British and then the U.S. Navy (through the Bretton Woods trade system) ruled the world. This is one reason that hegemony in the South China Sea is currently such a major issue—and an important issue for candidates to understand.

- Global surveillance and intelligence: This is one of the reasons the adoption of smartphones, chipping, and the smart grid is being pushed so aggressively.

- Space: Satellites and the suborbital platform have become the “sea lanes” of the 21st century, bringing in whole new levels of both surveillance and weaponry.

One of the strategic advantages that the U.S. enjoys is its western and eastern protection by two large oceans.

The central banking-warfare system can work profitably as long as the costs of governance and of funding military and intelligence capacity and enforcement are less than the subsidy generated from trading printed currency for real labor and resources. Needless to say, runaway corruption is currently eating into profitability.

Centralizers can mitigate the challenges of running the system by blunt force by putting into place a system of indebtedness, combined with sovereign reserves, that implements control through financial instead of overtly violent means and arranges an ongoing tithe back to the empire. In one sense, the goal of war is to get countries into this debt system. Enforcement of the “tithe” is increasingly achieved with the threat of financial sanctions and, of course, ultimately force. (For an example of how the global debt trap works, see the movie The International. It includes a great scene that explains the weapons business and its relationship to the creation of global financial dependency.)

The period since WWII has been characterized by a steady effort to print dollars and make other countries as well as American states, counties, and municipalities dependent on “free money,” whether in the form of government grants or dollar loans. This is also the goal of a so-called universal basic income—complete financial dependency. One of the reasons that the dollar remains “dangerous and dominant” is that most nations are in a dollar debt trap. Russia is one of the rare exceptions.

At the heart of the existing economics is a series of unanswered questions regarding the Anglo-American alliance’s weaponry and military power. I have spent many years trying to determine where all the trillions of dollars generated by U.S. government-sponsored mortgage fraud and HUD and DOD missing money were going. This leads to a rabbit hole of classified intelligence and disinformation on the reinvestment of black-budget funds and organized crime proceeds, including investments in underground bases and transportation networks, invisible weaponry, and global mind control systems, not to mention the potential setting aside of assets and permanent capital for what many call “the breakaway civilization.”

This maze of interrelated unanswered questions presents us with a puzzle palace lacking serious documentation and reliable information; for this reason, the matter is not often discussed publicly. Nevertheless, your plans for reengineering the federal finances and the related military machinery need to take these unanswered questions into account. If and when you get access to classified intelligence, digging out the real balance and cost of military power on the ground and in space must necessarily be a high priority.

The questions about advanced weaponry not only concern what it is but also who has it. For example, if the U.S. empire were to dramatically cut its budget and surrender or ratchet back its position as international hegemon, the question of whether others have such advanced technology is highly relevant. If so, would they then assume the U.S.’s dominant role? The notion of a breakaway civilization is quite real—and its maintenance is likely to command a significant stockpile of our stolen resources.

Can a candidate get sufficient intelligence on the real state of play in this respect before entering the Oval Office? My bet is that a full stand-down by the U.S. could result in a worse player becoming dominant. So, the question is how to transform the U.S. government and military to a system of economic integrity and accountability—within a multipolar world—without triggering severe deflation or facilitating the emergence of a worse tyrant.

The bottom line is that there is a direct relationship between the federal finances and our global military-intelligence model and strategies. If you change one, it needs to be part of changing the whole model and system. An in-depth analysis of the Kennedy Administration demonstrates the friction that occurs when a President begins to transform the whole model without the support of those who run it and profit from it. The latter include the segment of the U.S. workforce that is dependent on employment and income from the U.S. military-industrial complex. It is essential to recognize that this financial dependency is widespread throughout the voting population and will affect voters’ willingness to accept an otherwise healthy transition to an employment model that will lead to greater prosperity in the longer term. Educating the public and presenting attractive possibilities for alternative employment are essential ingredients to achieving popular support.

IX. A Word About Energy

I just finished doing an interview with systems engineer Charlie Stephens, which the Solari Report will publish in September. Charlie concludes that our greatest use of energy stems from the tremendous waste of energy resources in four broad areas:

- First, we have a secret governance system that is highly dependent on surveillance, organized crime, and warfare.

- Second, the current system relies on expensive technology that does not contribute to productivity or human and environmental health (this includes the control grid).

- Third, the past century has emphasized an industrial agriculture model rather than regenerative agriculture; a successful return to regenerative agriculture could solve a wealth of health, environmental, and financial problems.

- Finally, there have been steady efforts to prevent or thwart the adoption of innovations and investments in construction, agriculture, transportation, and energy technology. This includes suppression of breakthrough energy.

This brings us right back to the interdependence of the different aspects of the central banking-warfare model—including the federal finances that are at the heart of the model—and to the enormous energy consumption and environmental damage that the current model causes.

- See Breakthrough Energy Links at Hero of the Week

X. Next

There is an obvious question we must ask: What is our vision of a positive reset leading to a new, healthy economic and financial model, and what can a President and his or her team do to lead a productive evolution in that direction?

Until recently, leading such a transformative process looked like an impossible task. Now, however, the accelerating deterioration in the U.S. federal finances is creating an opportunity to have an honest discussion about what is going on and what we can do about it.

Future Solari Papers will focus on solutions as well as responses to questions and comments from candidates, legislators, and Solari subscribers. First and foremost, however, real solutions require starting with a clear look at where we are and the challenges that a new President will face in getting his or her hands on the federal financial machinery sufficient to implement meaningful changes.

Comments from Solari subscribers are welcome (post them at the end of this commentary after you login). Public officials who are not subscribers are eligible for complimentary subscriptions that some of our subscribers have graciously funded. Subscribers and readers interested in funding this effort can do so by clicking on the Donate button at Solari.com or by sending your contact information to our customer support (fill out a support ticket at Solari.com).

We want to thank you for your contributions to a future of freedom and peace, which are deeply appreciated. You never know what can happen until you try. We hope this paper will help support your continued efforts and success.

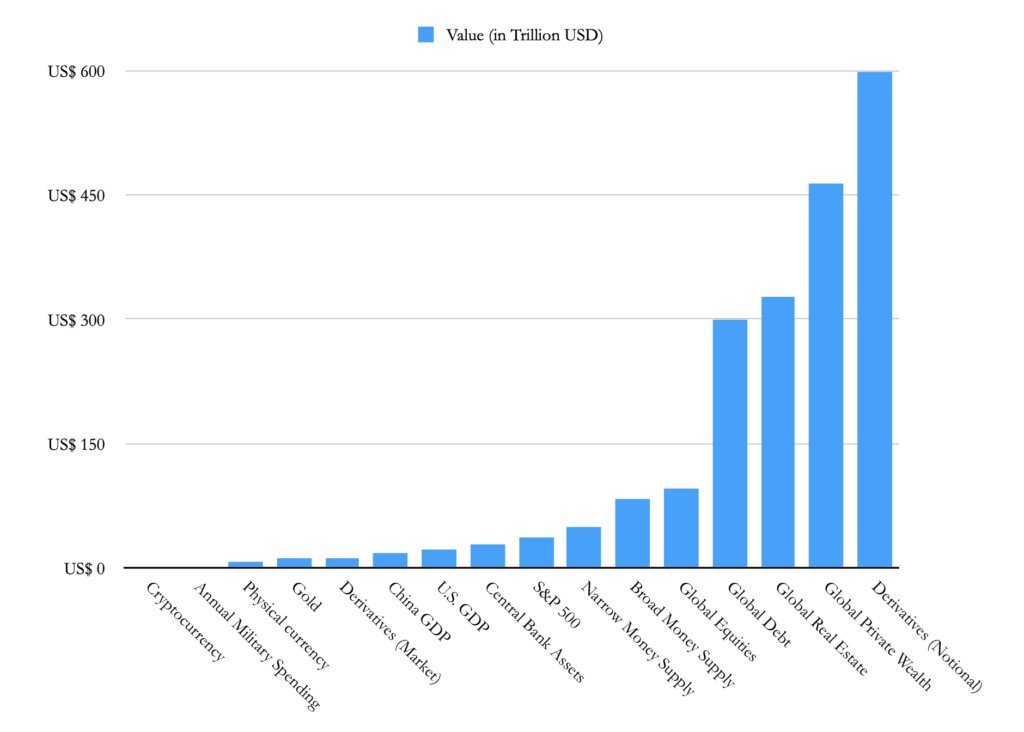

Appendix. Selected Statistics: Global Economy and Financial Assets

As of: August 2, 2023

- All of the World’s Money and Markets in One Visualization (2022) (Visual Capitalist)

- Visualized: The U.S. $20 Trillion Economy by State (Visual Capitalist)

- Ranked: The Largest Bond Markets in the World (Visual Capitalist)

Size of world’s money and markets

Data Source: Visual Capitalist

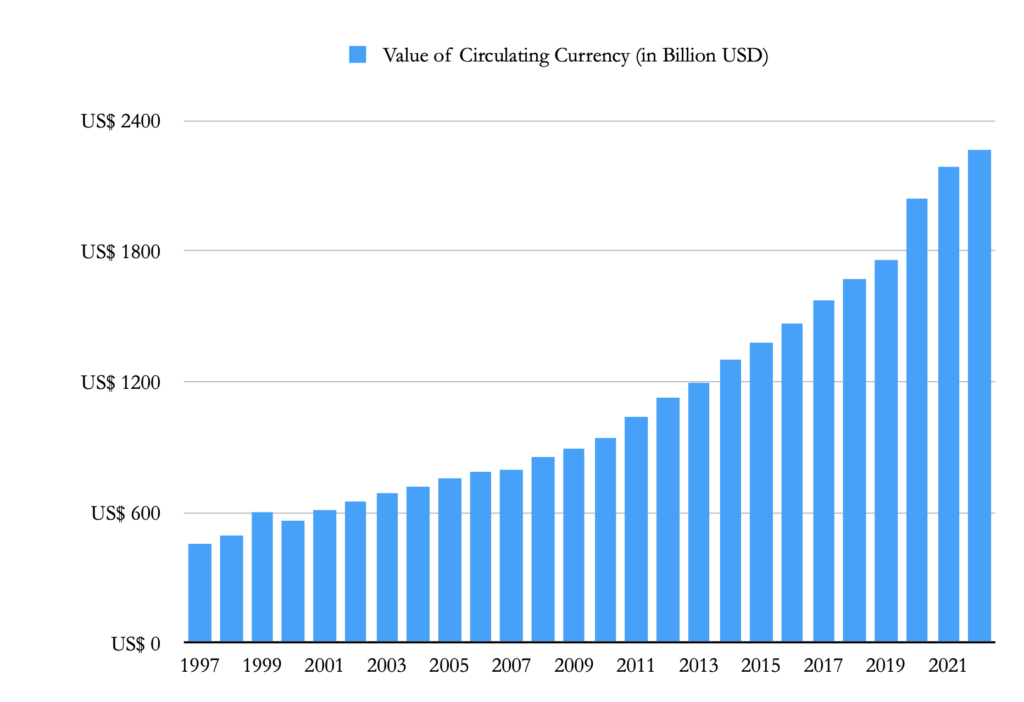

Currency in circulation ($2.2 trillion in 2022)

Data Source: https://www.uscurrency.gov/life-cycle/data/circulation

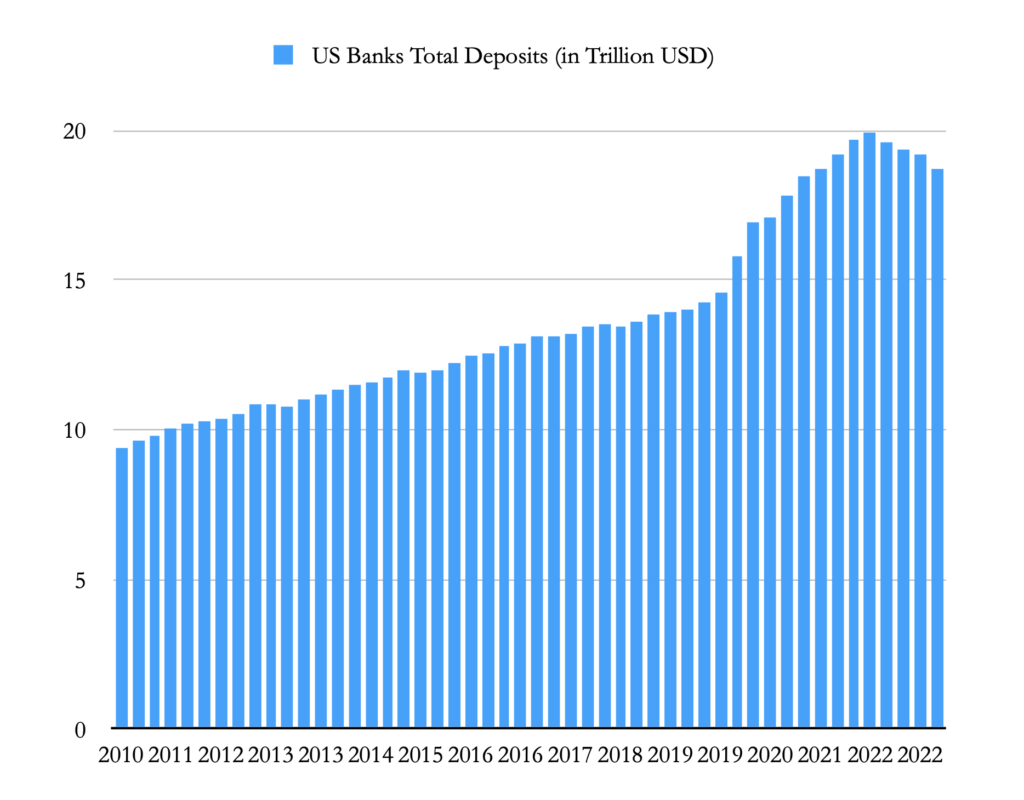

Deposits and reserves—dollars ($19 trillion in 2022)

Data Source: https://ycharts.com/indicators/us_banks_total_deposits

Deposits and reserves—Eurodollars

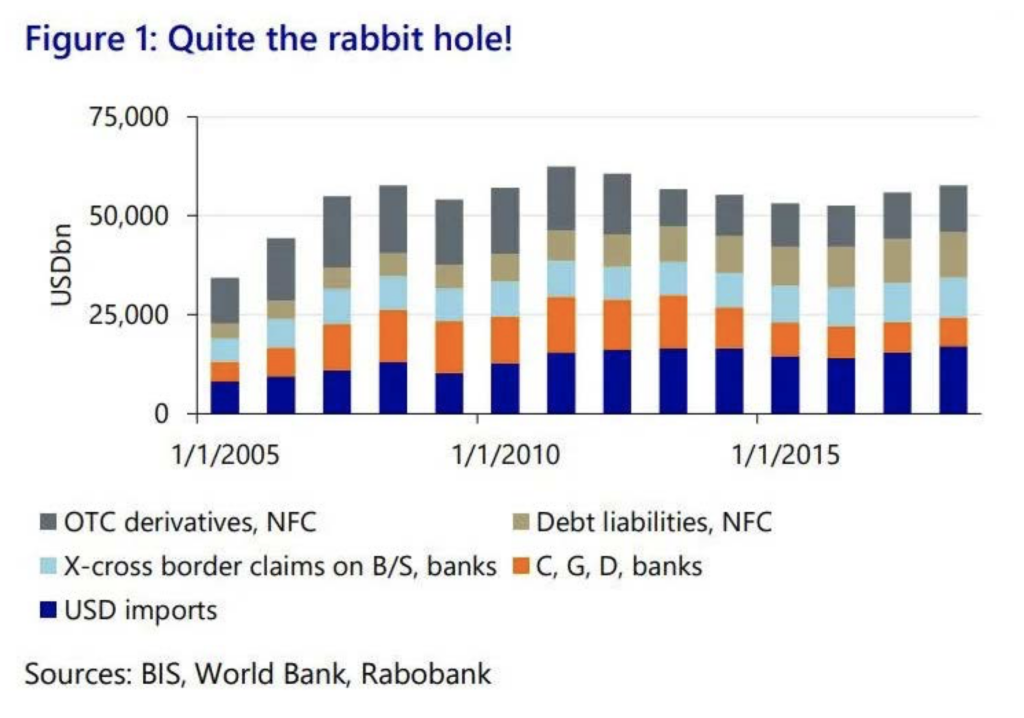

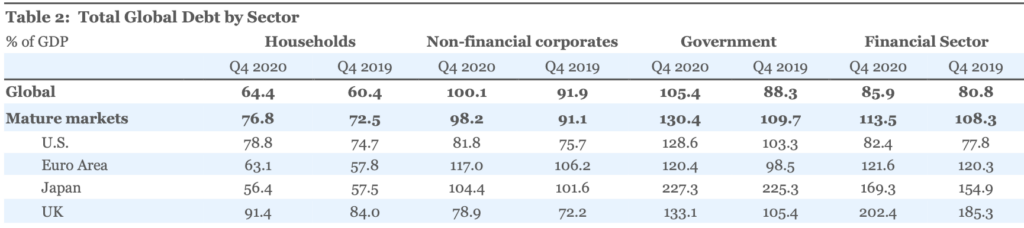

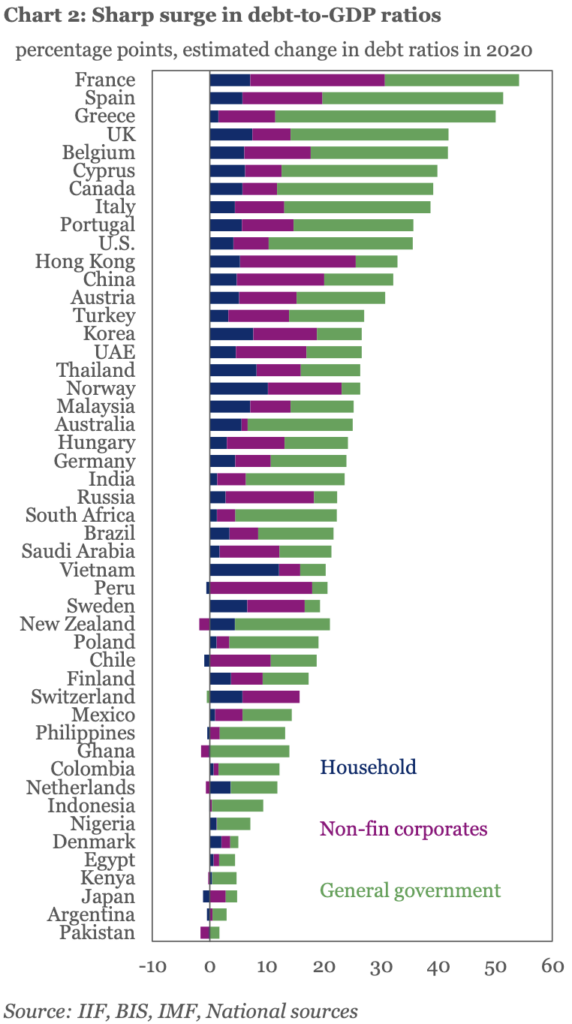

Dollar-denominated bonds and loans ($355 trillion in 2021)

Source: https://www.iif.com/Portals/0/Files/content/Global%20Debt%20Monitor_Feb2021_vf.pdf

Source: https://www.iif.com/Portals/0/Files/content/Global%20Debt%20Monitor_Feb2021_vf.pdf

Source: https://www.iif.com/Portals/0/Files/content/Global%20Debt%20Monitor_Feb2021_vf.pdf

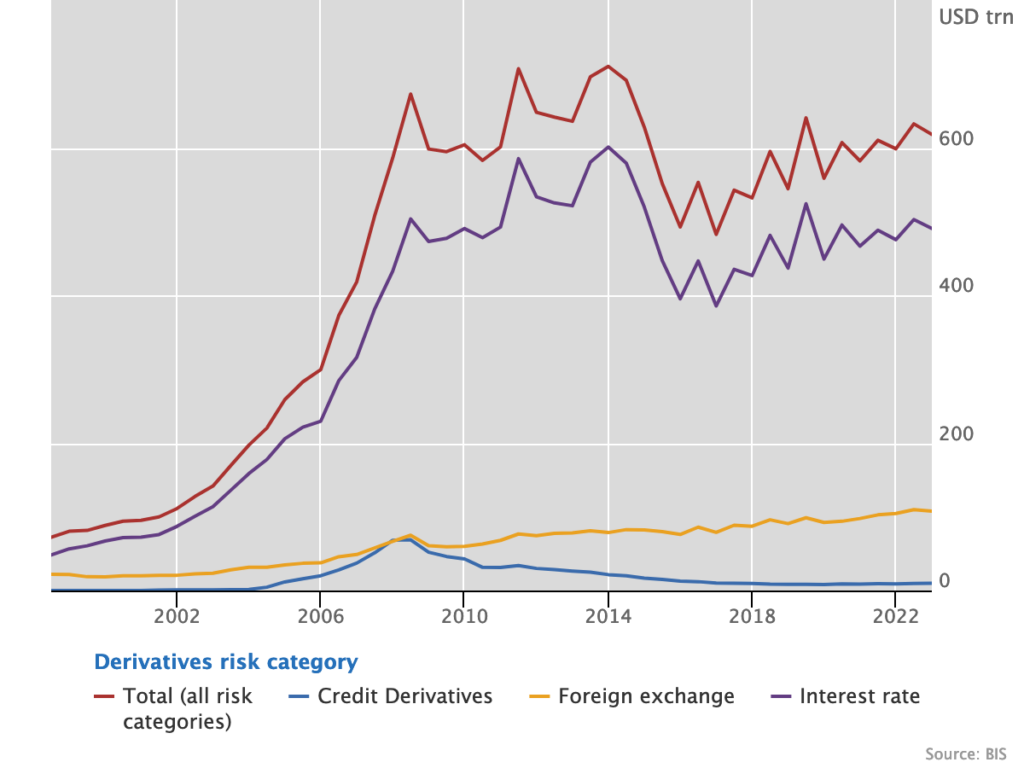

Dollar-denominated derivatives

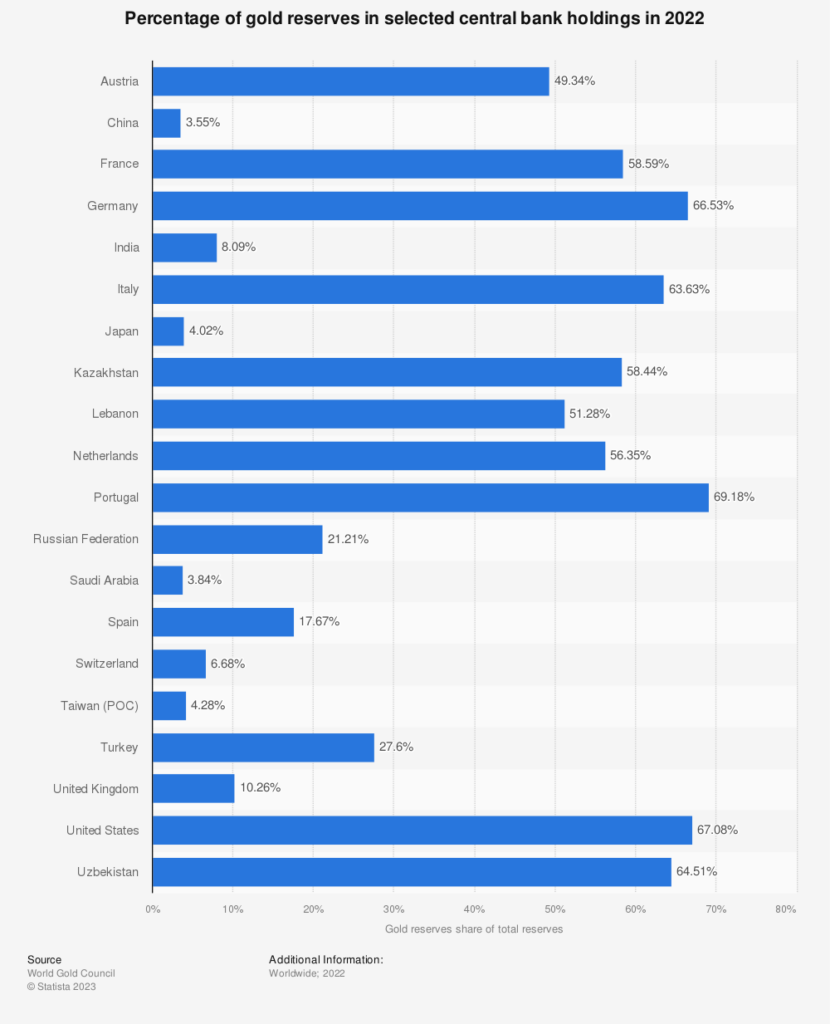

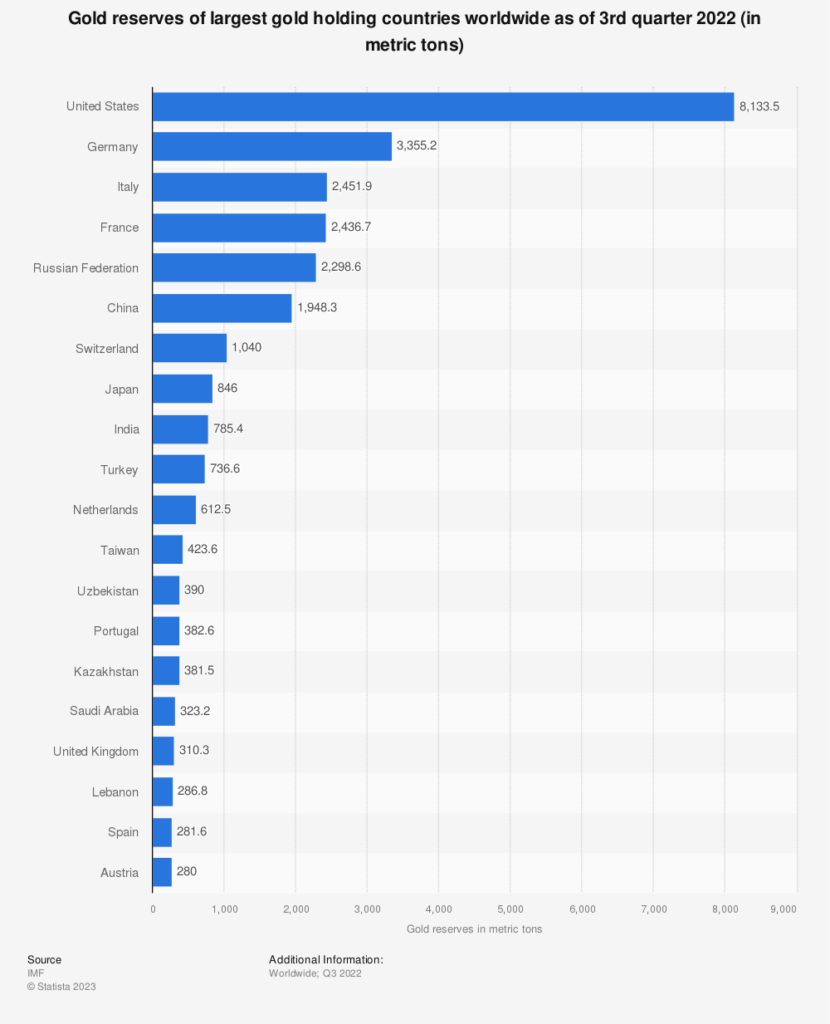

Gold

See https://en.wikipedia.org/wiki/Eurodollar (~ $14 trillion in 2016)

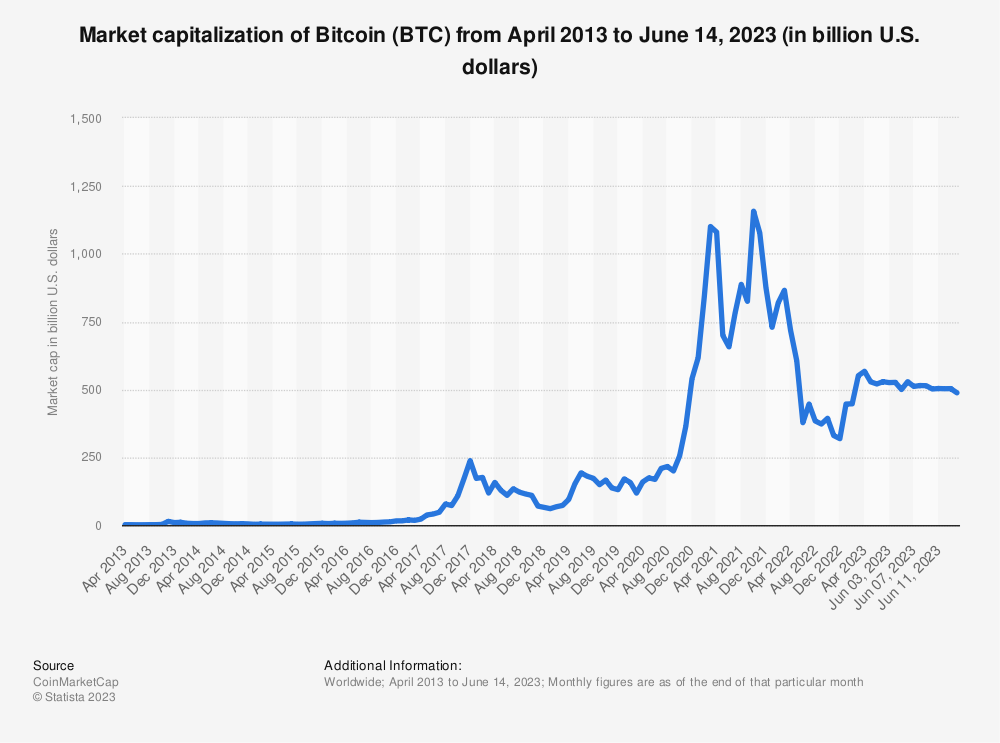

Market cap of Bitcoin

Size of world’s largest companies vs Bitcoin (BTC)

Source: https://companiesmarketcap.com/

Source: https://about.bgov.com/bgov200/